- …

- …

How a Currency Exchange Revolutionized Travel Money with Card Issuing

Discover how a leading currency exchange provider transformed its business model by introducing multi-currency prepaid cards, creating a seamless digital payment experience while significantly increasing revenue and customer retention.

The Challenge: Evolving Beyond Physical Currency

Founded in 2005, this currency exchange established itself as a pioneer in the currency exchange market with a proprietary online ordering system for consumers seeking foreign currency. The company quickly grew to serve individuals, corporations, and financial institutions including banks and credit unions.

As cash transactions globally declined and sourcing foreign banknotes became increasingly difficult and expensive, they faced a critical business challenge: how to maintain growth in their currency exchange business while adapting to shifting consumer preferences toward digital payments.

Their traditional business model relied on customers ordering foreign currency before international travel, creating logistical challenges and limiting transaction opportunities to pre-travel exchanges.

The Solution: Multi-Currency Digital Card Platform

This digital transformation allowed them to maintain its currency exchange expertise while pivoting to a more sustainable, technology-driven business model that aligns with modern consumer payment preferences.

Multi-Currency Card Development

They partnered with a card issuing platform to develop a multi-currency prepaid card that allows travelers to load and spend in multiple currencies without excessive conversion fees.

Mobile App Integration

A companion mobile application was created enabling users to check balances, switch between currencies, and instantly top up funds using their US bank accounts or debit cards.

Global Payment Network

The card was integrated with major payment networks, ensuring acceptance at millions of merchants worldwide and ATM access in local currencies without the security risks of carrying cash.

Implementation Strategy

They implemented a phased rollout strategy, first targeting existing customers who regularly ordered foreign currency. The company leveraged its institutional relationships with banks and credit unions to create white-label versions of the card program for partner distribution.

The implementation included developing a secure KYC process, establishing banking partnerships for multi-currency settlement, and creating a seamless user experience from card ordering through international usage.

Business Impact: Transformative Results

Revenue Growth

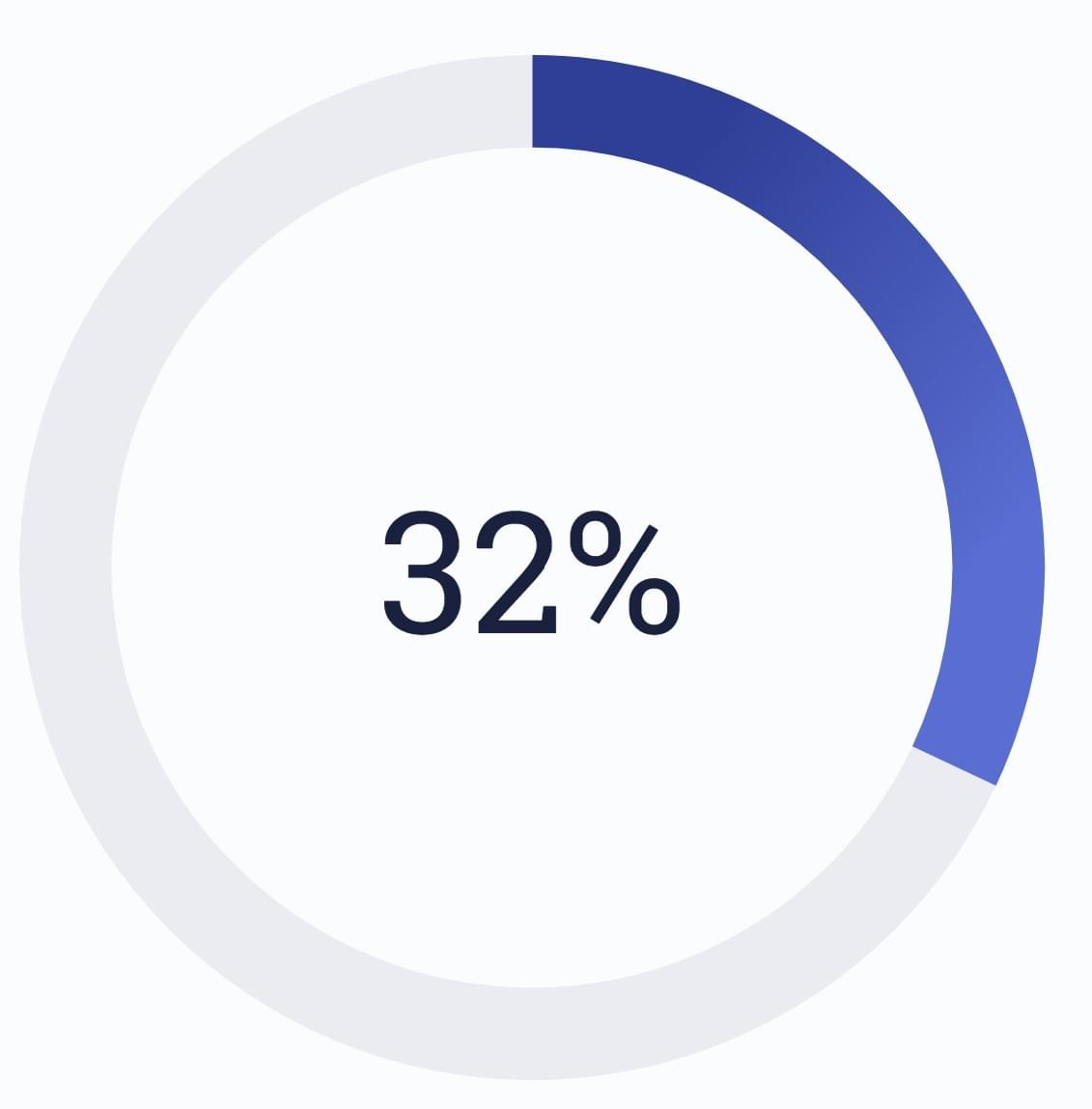

Year-over-year revenue increase driven by interchange fees, foreign exchange margins, and monthly subscription options.

Customer Acquisition

Increase in new customer acquisition compared to traditional currency exchange services alone.

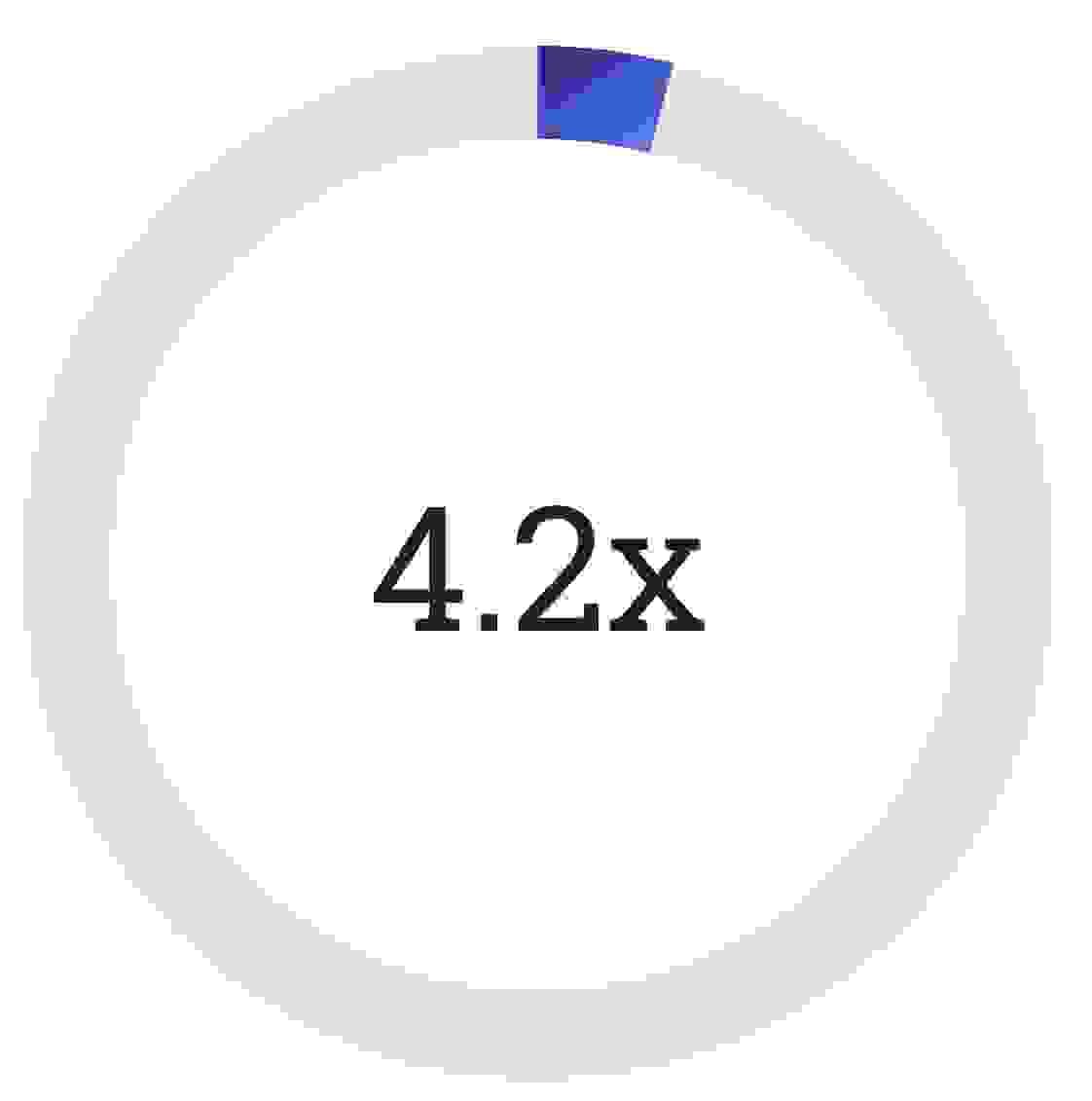

Customer Lifetime Value

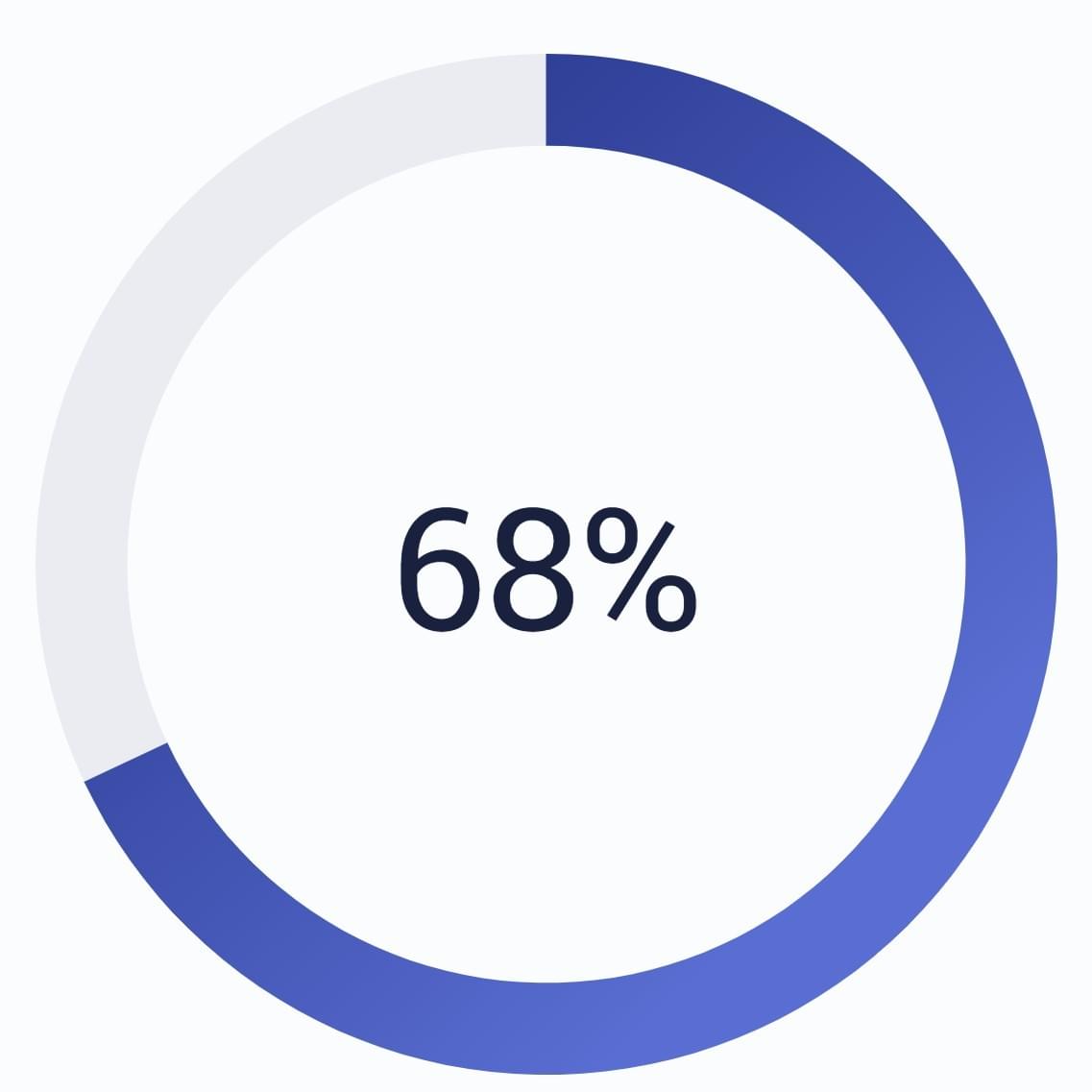

Average spend per customer increased as travelers used cards for multiple trips and online purchases in foreign currencies.

* The multi-currency card program transformed their business model from a transactional service to an ongoing financial relationship with customers. The digital product created significant stickiness, with 78% of card users reloading their cards for subsequent trips rather than returning to cash currency exchange.

Additionally, the company established a new revenue stream through partnership programs with travel agencies, airlines, and hospitality companies who now offer co-branded versions of the multi-currency card to their customers, positioning them as an essential player in the digital travel payments ecosystem.

Interested in Card Issuing?

Grandeliga, LLC

DISCLAIMER: Grandeliga, LLC is an advisory and payment solutions company registered in the state of Massachusetts. We are an ISO/agent of our partners.